Welcome to part 4 of our series on combating sales suppression. In our prior posts, we have discussed the magnitude and simplicity of perpetrating fraudulent sales suppression. We have also introduced changes you should consider to keep pace with these illegal practices. Let’s shift our focus to the pursuit of these cases.

Welcome to part 4 of our series on combating sales suppression. In our prior posts, we have discussed the magnitude and simplicity of perpetrating fraudulent sales suppression. We have also introduced changes you should consider to keep pace with these illegal practices. Let’s shift our focus to the pursuit of these cases.

Many states have done a great job of passing legislation to outlaw the sale or possession of a zapper. While it is difficult to effectively describe or ban the use of phantom-ware that is pervasive in most POS systems, many states are closing that gap. But is it optimal to chase every case as a criminal proceeding? While it sends a very effective message, XDS recommends a different approach to recover revenue rapidly and boost long-term compliance.

Pursuing sales suppression as a criminal offense requires a significant amount of procedural and staff burdens. Unlike a traditional audit, investigators and prosecutors are involved very early in the process to execute search warrants and potentially subpoenas. As the evidence is gathered and analyzed, those same people continue to expend energy on the case. As the case proceeds, prosecutors will be involved in proving every step of the case. This approach could result in your jurisdiction using some of their most constrained and expensive resources and people to pursue hundreds of cases every year.

The procedural overhead of proving a criminal case is significant. While we can hope the perpetrators admit guilt or accept a plea bargain, our over-burdened court system will be further taxed. Some states have a backlog of individual fraud cases worth $250,000 waiting for prosecutors to pursue them. Do you really want to place further burdens on the same system that should be removing drug dealers and murderers from your streets? What if we could find a balance that allows us to collect past due taxes and apply them where they belong: family assistance, education, public welfare, and transportation?

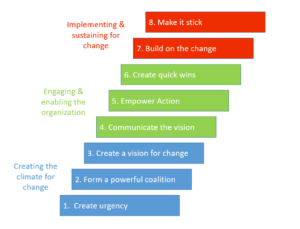

XDS recommends a balanced approach to criminal proceedings. Rather than adding to an overburdened judicial system, consider working within the bounds of a traditional audit framework. By increasing the volume and velocity of audits focusing on the scientifically identified least compliant taxpayers, you will be sending a strong message to offenders, increasing overall compliance, and more productively recouping past due taxes. This becomes especially relevant when trust taxes have already been collected from consumers yet retained by fraudsters. As you level the playing field, you may be able to reduce gross tax rates and achieve the same revenue objectives.

Pop quiz discussion:

Answer (a) will help you send a strong message. You do not need to wait to pass legislation banning zappers since fraud is already a felony. You will also benefit by including a press release and possibly coverage on the local news. Unfortunately, your state is going to lose money on this case due to the extended use of auditors, criminal investigators, prosecutors, judges, bailiffs, court reporters, and a jury.

Answer (b) will help you recoup past due tax dollars rapidly and productively as well as increase future compliance. It also assumes you have the processes and a strong partner to execute an aggressive program.

Answer (c) will help spread the word throughout the business community that “the game” may be over for them. It will automatically increase compliance. Since the techniques have spread word-of-mouth throughout the business owners and vendors, that same process will help eliminate the fraudulent practices over time.

Answer (d) will connect you with the only vendor that has the tools and techniques to provide you with specific details on fraudulently modified transactions. XDS can help you execute a high-velocity, high-volume program productively.

Answer (e) is the best answer. An effective program requires a balance of all of these elements.

To process sales suppression audits in greater volume and increased velocity, you will need to embrace new approaches. XDS isn’t here to state the obvious. We are here to be your partner in a faster, more efficient process. To understand some key changes associated with the optimized process, please see the next blog post in the series: focus on scaling productively.

To process sales suppression audits in greater volume and increased velocity, you will need to embrace new approaches. XDS isn’t here to state the obvious. We are here to be your partner in a faster, more efficient process. To understand some key changes associated with the optimized process, please see the next blog post in the series: focus on scaling productively.

As with all of XDS’ solutions, the process and organization elements are balanced with amazing technology. So while this broadcast sounds extremely technical, we’re certain you’ll find some key answers to how your organization can move forward regardless of the number of technology hurdles.

As with all of XDS’ solutions, the process and organization elements are balanced with amazing technology. So while this broadcast sounds extremely technical, we’re certain you’ll find some key answers to how your organization can move forward regardless of the number of technology hurdles. In our prior audit selection blog posts, we discussed the significance and benefits of data-driven audit selection. In our most recent post, we discussed the nuances of data management and the art of data science. We are confident that these will create major departures from how you have traditionally approached audit selection.

In our prior audit selection blog posts, we discussed the significance and benefits of data-driven audit selection. In our most recent post, we discussed the nuances of data management and the art of data science. We are confident that these will create major departures from how you have traditionally approached audit selection.

Data governance is not a one-time event or a barrier for initiating your transformation. You can start with a minimal number of data sources and qualify them incrementally. Starting with something is more valuable than starting nothing while you wait for perfection.

Data governance is not a one-time event or a barrier for initiating your transformation. You can start with a minimal number of data sources and qualify them incrementally. Starting with something is more valuable than starting nothing while you wait for perfection. XDS doesn’t just talk about the challenges and opportunities. We exist to help you rapidly realize the future. Turning the corner toward a data-driven and productive approach can be a significant initiative. To discover some key steps to gaining executive support for your transformation, return for our next post in the series: Build Executive Support for Progress.

XDS doesn’t just talk about the challenges and opportunities. We exist to help you rapidly realize the future. Turning the corner toward a data-driven and productive approach can be a significant initiative. To discover some key steps to gaining executive support for your transformation, return for our next post in the series: Build Executive Support for Progress.

The first big secret to driving a successful sales suppression intervention program is strong leadership. Your leaders are going to need to craft and communicate a strong vision. While it is important to listen to dissenting opinions sympathetically, your leaders need to remain steadfast on making the changes that facilitate high productivity. By understanding opposing views, they can adapt the program to boost your department’s success. They will also need to demonstrate a sincere and on-going involvement in the program execution.

The first big secret to driving a successful sales suppression intervention program is strong leadership. Your leaders are going to need to craft and communicate a strong vision. While it is important to listen to dissenting opinions sympathetically, your leaders need to remain steadfast on making the changes that facilitate high productivity. By understanding opposing views, they can adapt the program to boost your department’s success. They will also need to demonstrate a sincere and on-going involvement in the program execution. The final element to delivering hyper-productivity is a focus on continuous learning through iterative execution. If you are just starting a sale suppression intervention program, you are not likely to achieve perfection immediately. Delaying while waiting to achieve perfection prevents your taxpayers from receiving all of their benefits. You will achieve better results by starting small iterations of 10 audits per week, review the results every other week, adjust your processes, and initiate another batch. By working in increments that have scheduled learning sessions, you will have an opportunity to fine-tune your processes while boosting productivity.

The final element to delivering hyper-productivity is a focus on continuous learning through iterative execution. If you are just starting a sale suppression intervention program, you are not likely to achieve perfection immediately. Delaying while waiting to achieve perfection prevents your taxpayers from receiving all of their benefits. You will achieve better results by starting small iterations of 10 audits per week, review the results every other week, adjust your processes, and initiate another batch. By working in increments that have scheduled learning sessions, you will have an opportunity to fine-tune your processes while boosting productivity. XDS is not here to make vague recommendations. We are here to be your partner in an efficient, quick, and productive process along with guiding you through the critical changes.

XDS is not here to make vague recommendations. We are here to be your partner in an efficient, quick, and productive process along with guiding you through the critical changes. Welcome to part 4 of our series on combating sales suppression. In our prior

Welcome to part 4 of our series on combating sales suppression. In our prior

To process sales suppression audits in greater volume and increased velocity, you will need to embrace new approaches. XDS isn’t here to state the obvious. We are here to be your partner in a faster, more efficient process. To understand some key changes associated with the optimized process, please see the next blog post in the series: focus on scaling productively.

To process sales suppression audits in greater volume and increased velocity, you will need to embrace new approaches. XDS isn’t here to state the obvious. We are here to be your partner in a faster, more efficient process. To understand some key changes associated with the optimized process, please see the next blog post in the series: focus on scaling productively.

XDS’ solution goes beyond accurate identification of businesses that are suppressing sales. We offer tools and services to help you collect sales transaction data. The biggest challenge your peers face is the analysis of that data. XDS will remove that burden from your staff. Our service goes far beyond trend and anomaly detection. We will apply advanced analytics, machine learning, and deep data mining to identify specific details on fraudulent transactions. With our solutions, your department will be able to move quickly from data collection to closing an audit with strong evidence and confidence. This will allow you to collect overdue revenue and increase future compliance. Your department can benefit from the latest techniques and technologies with minimal training. XDS is your partner to close the gap between your department and the constant evolution of fraud practices.

XDS’ solution goes beyond accurate identification of businesses that are suppressing sales. We offer tools and services to help you collect sales transaction data. The biggest challenge your peers face is the analysis of that data. XDS will remove that burden from your staff. Our service goes far beyond trend and anomaly detection. We will apply advanced analytics, machine learning, and deep data mining to identify specific details on fraudulent transactions. With our solutions, your department will be able to move quickly from data collection to closing an audit with strong evidence and confidence. This will allow you to collect overdue revenue and increase future compliance. Your department can benefit from the latest techniques and technologies with minimal training. XDS is your partner to close the gap between your department and the constant evolution of fraud practices.